9280 S. Kyrene Rd.

Suite 134

Tempe, AZ 85284

Phone: +1 (888) 284-5197

Email: contact@handwrytten.com

You have been subscribed. Thank you!

The start of a new year is an excellent time to reconnect with your clients, show appreciation for their loyalty, and set the tone for a prosperous future. While digital greetings have their place, a personalized, handwritten New Year’s card can create a lasting impression that emails and social media posts simply cannot match. Handwrytten, a company revolutionizing personalized correspondence with AI-powered handwriting, makes it easy to deliver heartfelt cards that will delight and engage your clients.

Here’s why sending New Year’s cards is a smart move for your business and how Handwrytten can help you make the most of this opportunity.

Expressing gratitude strengthens the bond between your business and your clients. A personalized New Year’s card communicates that their loyalty is noticed and appreciated.

Example Message:

“Dear [Client Name], thank you for your trust and partnership throughout 2024. We’re honored to work with you and excited to continue collaborating in 2025. Wishing you a New Year filled with success and happiness!”

A handwritten card is a meaningful way to acknowledge your clients’ importance in your business journey, encouraging loyalty and repeat business.

In an age where inboxes are overflowing with promotional emails, a tangible, handwritten card stands out. A physical card offers a sensory experience that no email or digital post can replicate.

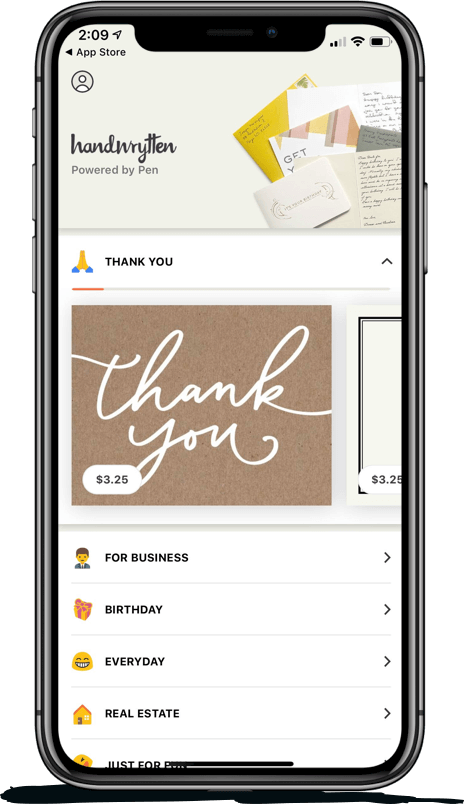

With Handwrytten, you can type your message or let their AI assist you in crafting the perfect note. Their advanced technology mimics authentic handwriting, adding a human touch to your communication. Choose from a variety of beautiful cards, or design custom stationery to reflect your brand’s personality.

Clients who feel valued are more likely to stick around—and recommend your services to others. Sending New Year’s cards demonstrates your commitment to the relationship and opens the door for future opportunities.

Example Message:

“Wishing you a Happy New Year, [Client Name]! Thank you for being such a vital part of our journey in 2024. If you know someone who could benefit from our services, we’d be honored to help them, too. Here’s to a successful 2025!”

This small gesture of appreciation can have a ripple effect, inspiring loyalty and word-of-mouth referrals.

The thoughtfulness of a handwritten card can feel daunting if you’re managing a large client base, but Handwrytten simplifies the process. Whether you’re sending one card or thousands, you can personalize each message without sacrificing time or authenticity.

By referencing specific projects, milestones, or achievements, you show clients that you truly value their partnership. Handwrytten’s tools make it easy to customize your cards to reflect the unique relationships you’ve built.

New Year’s cards aren’t just a communication tool—they’re an extension of your brand. Use custom designs that incorporate your logo, colors, and style to create a cohesive message. A well-designed card reinforces your brand’s professionalism, creativity, and dedication to detail. Handwrytten’s customizable stationery options make it simple to align your cards with your brand identity.

Personalized New Year’s cards are not just for existing clients; they’re also an effective way to capture the attention of potential customers. A beautifully crafted card can introduce your brand and demonstrate the care and attention you provide to all your relationships.

Example Message:

“Happy New Year, [Prospective Client Name]! As 2025 begins, we’d love the chance to partner with you to achieve your goals. Here’s to new beginnings and exciting opportunities—let’s connect!”

This approach shows that your company values personal connections, making you more memorable to potential clients.

Handwrytten eliminates the hassle of handwriting individual cards without sacrificing the personal touch. Here’s how it works:

Whether you’re sending a few cards or a thousand, Handwrytten ensures your communication is heartfelt and professional.

A: Yes! Handwrytten allows you to create custom stationery featuring your logo, brand colors, and other design elements to reflect your business’s unique personality.

A: Handwrytten uses advanced AI technology to replicate the look of authentic handwriting. You can even choose from different handwriting styles to match your preferences.

A: Absolutely. Handwrytten makes it easy to scale your efforts by offering bulk sending options while still allowing for personalized messages.

A: It’s best to send your cards in early December to ensure they arrive during the festive New Year’s period.

A: Delivery times vary depending on location, but Handwrytten ensures prompt mailing. For precise timelines, contact their customer support team.

Sending handwritten New Year’s cards is a simple yet powerful way to strengthen client relationships, enhance brand loyalty, and create opportunities for growth. With Handwrytten, you can personalize every message without the hassle of handwriting each card yourself.

Make your mark this New Year—visit Handwrytten today to craft your first card and start 2025 with a meaningful connection. Your clients will thank you!

Scale your handwritten outreach, creating positive impressions and long lasting bond.

Sign Up Today!

Over 100 designs to choose from or design your own. Our online card customizer makes it simple.

Check Out Our Cards!