9280 S. Kyrene Rd.

Suite 134

Tempe, AZ 85284

Phone: +1 (888) 284-5197

Email: contact@handwrytten.com

You have been subscribed. Thank you!

Real estate marketing trends have significantly evolved over the past few decades. Leaps in technology enable real estate agents, homebuyers and homesellers to connect with sellers easier than ever before.

The way people purchase and sell homes will continue to change, especially with the help of new innovative marketing techniques. So as we look ahead, we will make some bold predictions for 2023.

These predictions may seem far-fetched now but can come true in just a few years. With the rise of social media and real-time information sharing, we have more data available.

This data gives us clues about where the real estate industry may be heading soon. This article will examine some real estate marketing trends for 2022, so read on if you want to stay ahead of the curve.

Ten years from now, what will the real estate industry look like? How will marketing change? Where will the opportunities be? Will technology be even more critical than it is today?

These questions are impossible to answer with certainty. Real estate marketing trends constantly change to stay fresh and give customers exactly what they’re looking for. There are a lot of marketing trends expected to stand out over the next five years or so.

Real estate marketing agents have long been aware of the importance of home photos in attracting buyers to their listings. Virtual home tours are becoming more and more popular around the country. This technology allows buyers to walk through homes without visiting them in person.

The marketing strategies will need to adapt to meet the increased need for property investment that these trends bring about. Keeping up with the latest housing market developments can be challenging. This claim is especially valid if you’re designing marketing strategies for your organization.

From personalized messaging to augmented reality, it’s going to be an exciting time to be in the business of connecting people with places. Here are three reasons why you should change your marketing strategy. Try our handwritten notes for real estate agent to boost your conversion rate!

As bandwidth and storage capacity grows, we expect our social media platforms and databases to become more accessible. As a result, it’s time for digital business owners to up their game.

As our focus moves from print to digital, you can expect these trends to grow stronger and stronger. This advancement means more access to powerful tools for the housing market.

Investing more money into innovative digital marketing will help you stay ahead of your competitors. As new technologies evolve, such as artificial intelligence (AI), it becomes crucial for businesses to invest in them.

By joining forces with other businesses, you’ll have access to a more incredible pool of expertise and workforce. Strategic partnerships are compelling if they allow you to share customers or build products together.

Real estate professionals are constantly trying to stay on top of the latest real estate marketing trends. They do so to gain an edge over their competition and reach more potential clients.

Below are the top innovative real estate marketing trends for 2023. Each trend provides real estate agents with new ways to reach more clients, develop more leads, and close more deals more efficiently

Homebuyers will be able to use VR headsets to take virtual tours of homes. Afterward, they can walk through and experience it as if they were there.

Real estate marketing agents will be able to offer customers a much more immersive. This experience makes them feel like they’re actually at home. They’ll be able to zoom in on all of your excellent features and get an idea of what they would like their new home to look like.

You can use an influencer with many followers who live in a community dominated by your target demographic. They are easier to connect with because they are closer to home. And they may have greater credibility among their followers because they don’t come across as being selly.

People will sell their homes without meeting a real estate marketing agent. This method will be an acceptable alternative to doing business by 2023. We’ll see similar trends continue to evolve with other transactions, such as new builds and flips often on social media.

The old-fashioned sign on your lawn is just not attracting enough buyers. If you want to sell your home in 2023, consider investing in something a little different: digital signs and posters. Video marketing is also far more eye-catching than your typical clunky sign.

Every property should have its single-property website. These websites don’t need to be sophisticated; they need to host information about each unit in your portfolio.

These sites can help a real estate agent get more traffic by boosting SEO (search engine optimization). Because of their location, single property websites rank well on Google Maps searches.

Aerial photographs provide a high view of your home, showing prospective buyers all sides and opinions. By seeing details in rooms from a vantage point they can’t easily reach, you put them into your home and give potential buyers a deeper look.

As a real estate professional, it’s important to consider innovative ways to market your business, and part of that involves using various social media platforms. 88% of millennials use Facebook at least once a day.

This statistic makes it an invaluable resource for reaching out to consumers in your desired target market. Posting on relevant social media groups can also help you connect with other professionals in your field, leading to valuable collaborations.

In 2023, owning a starter home may be cheaper than renting in some markets. With mortgage rates seeing historic lows, homeownership can be a great value. First, however, renters considering moving to homeownership should research to ensure it’s right for them.

People’s home sizes will continue to increase over time as family sizes get more prominent. More people will start using their garages as additional living space, which means that garage doors must also become more innovative and attractive.

Outdoor kitchens and porches will become increasingly popular due to our desire for fresh air and outdoor activities like grilling. This trend is already evident in some suburbs where backyards are disappearing due to increasing population density.

With more job searches beginning online, your real estate brand needs to be loud, clear, and reliable. Use analytics to determine your audience’s preferences and how they engage with you across all of your platforms.

Then use these insights to optimize campaigns and create cohesive digital and physical brand experiences. Be sure to take advantage of data management and marketing automation tools to get ahead of your competition.

Today, robotic process automation is making waves in many industries. While it’s still best known as a cost-savings measure in banking and insurance, it’s quickly expanding into other sectors.

RPA can automate many of your tasks to help streamline your business processes. In real estate, you can use RPA for property management activities such as tenant screening, lease signing, rent collection, etc. It will free up time to focus on more strategic initiatives that add value to your business.

For real estate agents, digital transaction management is one of those trends that will begin to see adoption in more significant numbers as we move into 2023. By streamlining these processes, DTM makes it easier to process home purchases at scale, thus increasing your volume and building your business further.

AI technology can also offer new marketing opportunities and improve sales conversion rates. For example, you could use AI to analyze your customers’ online behavior and create targeted ads based on their preferences. This trend would make your ad more relevant to each customer, likely increasing its impact.

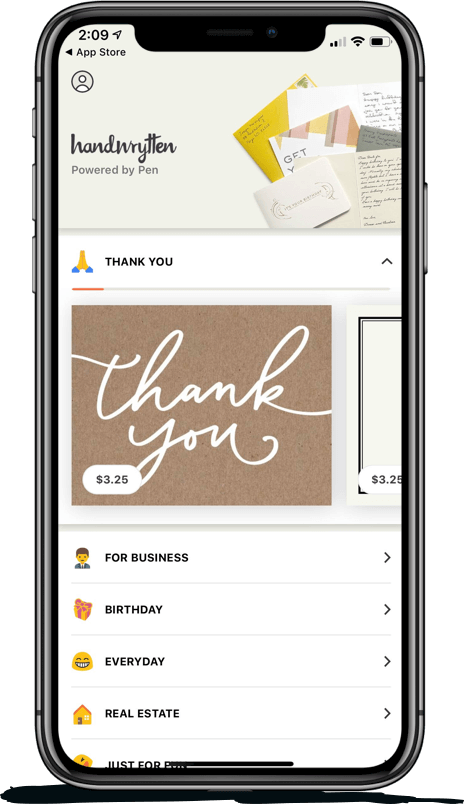

Scale your handwritten outreach, creating positive impressions and long lasting bond.

Sign Up Today!

Over 100 designs to choose from or design your own. Our online card customizer makes it simple.

Check Out Our Cards!